CPG Insights: How to Quickly Validate Your Go-to-Market Strategy

[…]

Agile insights are having a moment in the CPG industry

Developing a go-to-market strategy can feel a lot like playing darts. You hope to hit a bullseye but can just as easily miss the mark.

Fortunately, you don’t have to close your eyes and hope for the best. Instead, you can use agile research to validate your go-to-market strategy. From understanding your ideal customer’s purchase behaviors to knowing what words resonate with them, agile research helps guide you to a perfect bullseye.

In this post, you will learn:

- Why is agile research the preferred method for fast-paced brands?

- Which go-to-market strategy components can you test and validate?

- Examples of how to validate your go-to-market strategy.

Recommended: Market Research Process: 7 Ways To Improve What You’re Doing

What are Agile Insights?

Agile research is an iterative process designed to get consumer insights in less time. Instead of doing one long survey, agile research utilizes a bite-sized approach.

Ask three to five questions → Analyze the results → Use the findings to guide the next round

Agile methodologies are increasingly popular in software development. Instead of making an end-to-end plan on how to build out every feature, developers tackle one issue at a time. They regroup to see what they learned and then decide what to focus on next based on their findings.

Using a similar approach for your go-to-market research helps you fine tune your strategy as it develops instead of reworking everything after you’re finished.

For example, if you’re trying to test ad creatives, here’s how agile research would help:

- Send a survey to find out what messages / images resonate with them.

- Create a couple different versions of an ad based on their feedback.

- Send a new survey to get feedback on the ad options you updated.

- Tweak the ads or narrow it down to the best one or two based on the survey results.

With traditional research, you have to ask what resonates and test creative in the same research project.

Differences Between Traditional and Agile Research Methods

To understand why more companies are adopting agile research methods, take a look at what makes agile research different from traditional go-to-market research.

| Traditional Research | Agile Research |

| Slow results. You may have to wait weeks or even months to get results from a traditional research project. This doesn’t allow you any time to adapt your plans based on the feedback. | Fast results. Agile research can deliver results in less than 24 hours. Not sure what your target market will think about an ad headline? You can have actionable insights in your inbox the next day. |

| Outsourced to a third party. Companies often hire specialized firms to conduct traditional research, leading to delays and higher prices. | Managed in-house. Agile research can be managed in-house as a more time and cost-effective solution. |

| Lengthy. Traditional surveys have 10, 20, or even more questions, leading respondents to zone out before they finish. | Short. Agile surveys use short bursts of 1 to 5 questions to keep respondents engaged, which improves the quality of the feedback. |

Why is Agile Research the Preferred Method for Fast-Paced Brands?

If COVID-19 taught us anything besides the importance of washing your hands and covering your mouth when you cough or sneeze, it was that things can change quickly. Businesses must be nimble to survey in a fast-paced market.

Think of all the wasted research conducted in the first quarter of 2020. Traditional research results from surveys in January or February didn’t get delivered until March or later. The world changed overnight. The results didn’t matter and provided no value other than as a possible emergency toilet paper substitute.

Brands prefer agile research because they can receive and react to feedback and changes in the market quickly. Speed is becoming increasingly important.

The percentage of research professionals who consider speed of results a top priority has increased steadily from 52% to 60% in the last two years, according to the 2022 Greenbook Research Industry Trends.

Agile research also opens the door to conducting research more often throughout the year. Without the lengthy setup and high price of a full-service firm, agile empowers teams to conduct research in-house and use data-backed insights to guide business decisions.

As marketing budgets continue to decline, more people are turning to agile to help fill the gap. According to Greenbook, 76% of insights buyers currently use or plan on using agile research, methods, or approaches in the next year.

How to Use Agile Research to Develop a Go-to-Market Strategy

From New Coke to Segways, there are plenty of examples of disastrous product launches.

One of the greatest strengths of a go-to-market strategy is its ability to determine whether the venture is feasible and will interest the market.

Given that we’re not riding a Segway to the grocery store to pick up a 12-pack of New Coke, the answer for those products was clearly no. They were not feasible or interesting.

While it can be hard to accept when the answer is no, a go-to-market strategy involving honesty, realism, and humility can save you and potential investors a lot of time, money, and energy.

When the answer is yes, you can move forward with solidified confidence, a deeper understanding of the big picture to make better decisions based on, and a stronger plan of action to present to investors and get them involved.

Let’s look at the three go-to-market strategy components you can test and validate:

- Product-Market Fit: Identifying your customers and their buying criteria.

- Buyer’s Journey: Understanding your customers’ needs, motivations, and hesitations.

- Message Testing: Defining brand & product messages that resonate.

1. Product-Market Fit

Purpose: To Understand your customers and their buying criteria.

Nothing is as irreplaceable as a great market. In building a strong brand that connects deeply with customers, you must conduct discovery to gain an understanding of customers’ needs and the trends, forces, and brands that compete for their attention.

For example, is there growth potential for ready-to-drink coffee? To know, we have to understand the habits of coffee drinkers. You must get inside your customers’ heads and determine what they think, how do they behave, and what do they need?

In a recent OnePulse survey, we asked U.S. consumers about their perceptions of ready-to-drink coffee products. Here’s what we found:

- Close to 45% of Americans who have tried ready-to-drink (RTD) coffee typically purchase it at least once per week.

- About 21% of U.S. coffee consumers rate ready-to-drink coffee as “better” or “much better” than freshly brewed coffee.

In addition to discovering what the market thinks about a niche product, we also unveiled those consumers’ purchase habits to understand what type of ready-to-drink beverages they consume and how often they consume them.

You can use these types of insights to refine your marketing, product, and distribution strategies.

If you want to test your product-market fit, add some of the questions below to your research.

Common questions for testing and validating products and services:

- When was the last time you purchased a similar or same product/service?

- Why did you purchase that product/service?

- What could trigger you to switch from your current or preferred product/service?

- What is your greatest fear when purchasing this product/service?

- Which pricing model do you see as a good fit for this product/service?

2. Buyer’s Journey

Purpose: To eliminate obstacles and win more deals by understanding your customers’ needs, motivations, and hesitations.

Most people are not in search of more opportunities to buy things. Understanding the path to purchase is vital in driving brand preference, and it starts long before consumers start considering product features and price. Buyers don’t care about features and prices before they know they need your product.

Three Steps in the Buyer’s Journey

- Become aware of a product or service

- Evaluate it.

- Buy it.

Today’s buyer is more informed and complex than ever before. From online reviews to social media recommendations, buyers have to evaluate information from several different sources.

Getting back to coffee, but this time fancy barista-made drinks, how do people decide what new drinks to order.

In another recent OnePulse survey, we found about 1 out of every 3 U.S. coffee drinks have ordered a specialty coffee drink because they saw it on social media.

In addition to discovering what influences purchase behaviors, we were also able to uncover some interesting insights on the actual purchase experience itself, ranging from where they purchase coffee, to the specific coffee orders they place, to their preferred coffee roasts.

By understanding the buyer’s journey, the pains and problems, and influencing factors, companies can better empathize with the buyer and position their product or service along that path.

Use the questions below to explore your buyer’s journey.

Common questions for testing and validating the buyer’s journey:

- What steps do you take before making a purchase?

- Where do you go to find information on the products and services you’re interested in?

- How much time passes between researching and purchasing a product or service?

- Which type of information or content is required for you to make a purchase decision?

3. Message Testing

Purpose: To identify the words that work.

It’s not enough to be different. You must be unique.

Marketing messages should connect with your customers and drive desired actions. But how do you know if the message is actually resonating with the audience? The best way to eliminate the guesswork is message testing.

For example, here’s how we asked coffee drinkers what resonates with them.

We learned what word associations are most common among consumers, like latte, cold brew, and mocha, and we also A/B tested two different messages to see which ones resonated most with respondents.

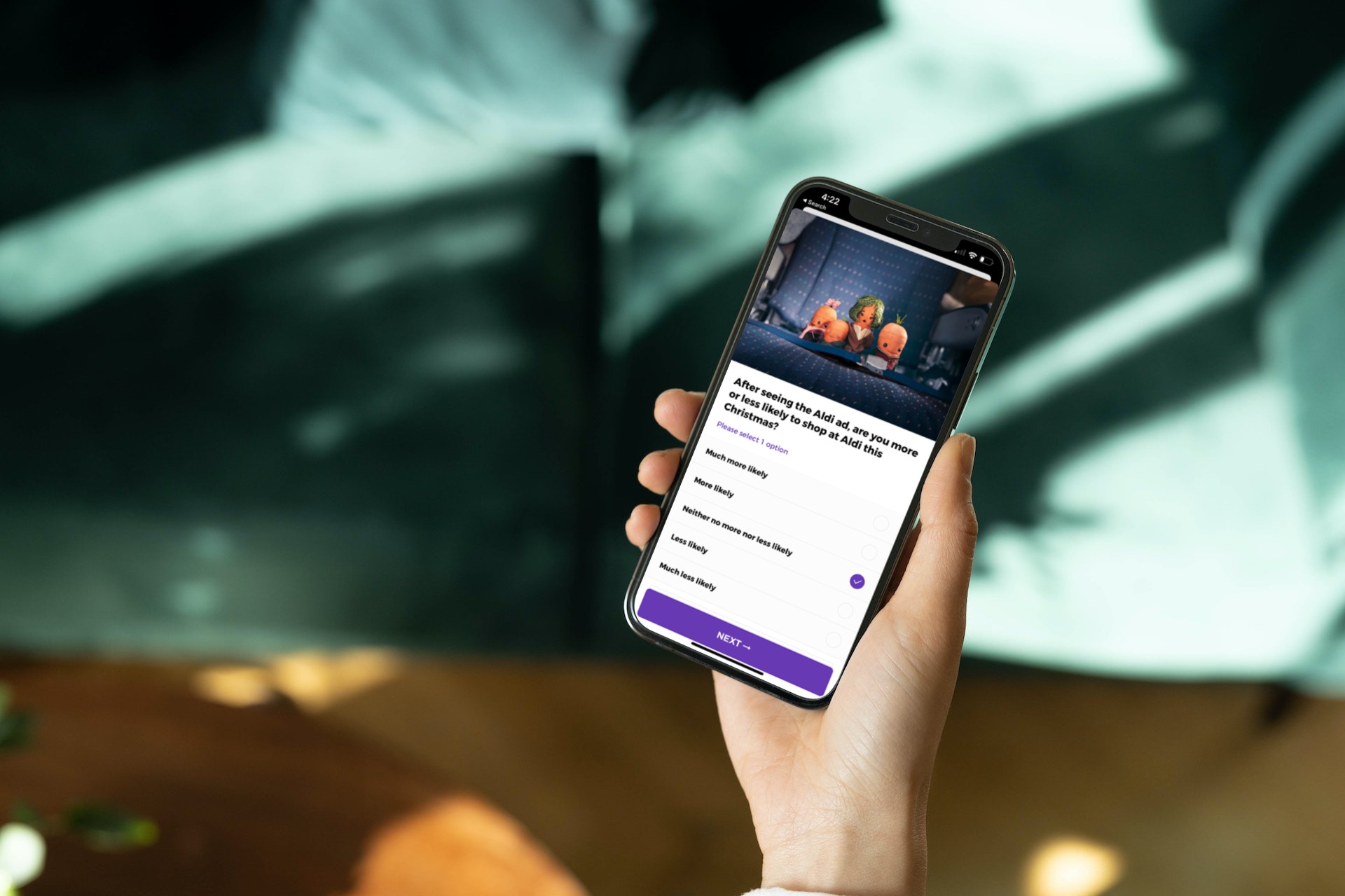

A similar method could be used to test value propositions, brand messages, images, and even videos so that you hit the mark before investing (or wasting) time and money on content that doesn’t resonate with your audiences.

When testing ad creative, use the questions below to fine tune your messaging.

Common questions for testing and validating brand messaging

- Do you have an instant understanding of what this message is expressing?

- Did you understand what action this particular message wants you to take?

- Does this message make you feel inspired to take action?

- Did the message uncover any hidden needs you weren’t previously aware of?

Unlock the Power of Agile Research With OnePulse

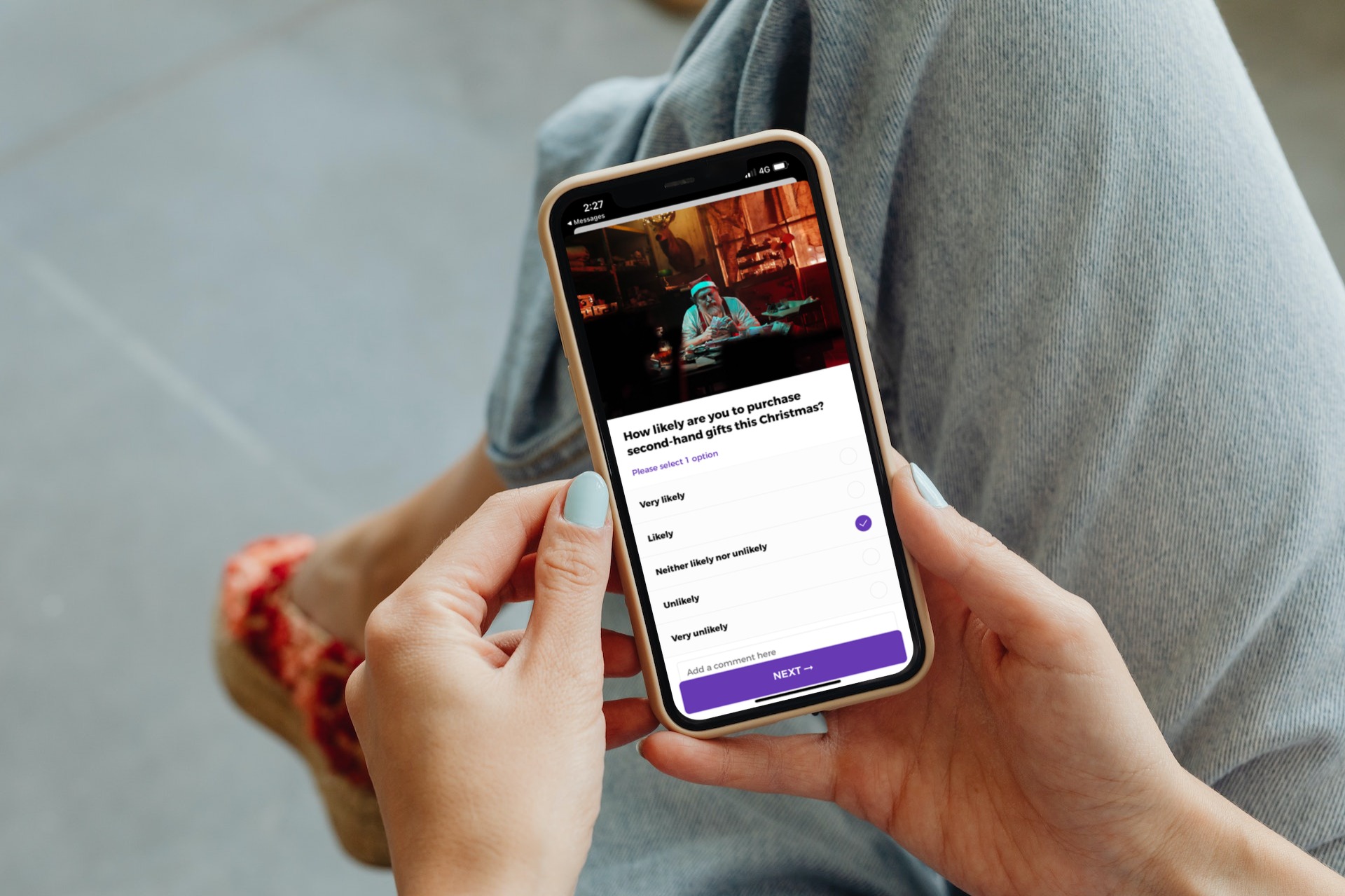

OnePulse makes validating your go-to-market strategy simple. You can reach people where they’re most comfortable: on their phones in a user-friendly and engaging app.

Agile research with Onepulse provides businesses with unmatched flexibility. Develop better campaigns and go-to-market strategies by:

- Keeping a pulse on the opinions and actions of your audience at all times. Monitor how your brand is perceived and track the purchase behaviors of customers, prospects, and other stakeholders.

- Capturing consumers’ attention throughout the buyer’s journey. Verify with your target audience that the messaging, imagery, and video assets resonate before launching your next campaign.

- Becoming a consumer-centric brand. Focus on what works by involving consumers early and often in the product development process.

Related posts