Determining Market Research Sample Size: Am I Reaching Enough People?

[…]

How to make sure you get a good sample size for quantitative and qualitative research

Are you ready to start your next insights project, but stumped by the age-old question: What market research sample size should I use?

Don’t worry, there’s a formula for that.

Whether you are brainstorming business ideas, launching a marketing campaign or simply expanding a product line into new regions, having clear and actionable market research to lean on can be the difference between success and failure.

However, conducting an effective study and deciding what sample size is right for your research involves more than calculations. Market researchers often need to factor in feasibility and budgets in deciding what sample size to use.

In this post, we’ll cover:

- The importance of selecting the right sample size,

- How to determine what sample size you need, and

- Sample size best practices for market research

| 💡 Why should I invest in market research at all?The benefits are clear >> It reduce the risk of making a big or preventable mistake >> It helps you understand target customers in more depth >> It allows you to analyze market size and potential |

What is sample size?

Sample size is a term to describe a population of respondents in a market research survey, project or study. Having a good sample size in market research allows you to understand how a larger group of people thinks and behaves as a whole.

When surveying a population of hundreds or thousands of respondents, it’s nearly impossible to expect everyone to get back to you. This is why having an accurate, statically significant sample size makes a huge difference to your success.

If your sample size is too small, you increase the chance of getting skewed results. In contrast, if your sample size is too large, the research project can easily become too costly or time-consuming.

For example, let’s say you’re trying to determine the percentage of people who prefer Dr. Pepper over Coke, so you know how much of each soda to buy for a party.

You’ve got 100 people coming to the party. You ask two of the guests who both prefer Dr. Pepper, so you don’t buy any Coke. By only surveying two people, the chance of getting two Dr. Pepper fans was pretty high.

You also don’t need to spend the time asking all 100 people which flavor of soda they want to get a general idea of how to stock your fridge.

Recommended: Three-question online survey templates that work

How to Determine Sample Size in Research Methodology

To choose the right sample size in market research, first you must gain a basic understanding of the lingo and statistics involved.

Who’s ready for a math lesson? For statistically significant results, you can use a formula to determine what sample size you need.

Statistically significant is a fancy way of saying the results from the sample survey have a high probability of matching or being really close to the results if you surveyed the entire population.

| The formula for a statically significant sample size is: Sample Size = (Z-score)2 x Standard Deviation x (1 – Standard Deviation) / (Margin of Error)2 |

Sample Size Variables to Consider

- Population. If the entire world population was available to you, what percentage would and would not fit within your target audience? It’s common for this to be an estimate and not an exact number.

- Margin of Error. Also known as confidence interval, is about how much error you’ll allow. The actual results could vary by a set amount. You’ve likely heard this mentioned in political polling. For example, 51% of voters said they would vote yes on the school bond with a margin of error of plus or minus 5%. That means the actual results could range from 46 to 57%. Political polls may need smaller margins of error, while market researchers can use 5% or greater.

- Confidence Level. This deals with how confident you are in your results and whether they accurately reflect the overall market. The most common confidence intervals are 90% confident, 95% confident, and 99% confident.

- Standard Deviation. This is a measure of variability in your responses. Will most respondents answer the same, or will there be a large range in responses? Odds are, if you knew the answer, you wouldn’t be doing the survey. You can use .5 as the default.

4 Sample Size Best Practices in Market Research

Most people don’t pursue careers in marketing because of their passion for complex math equations. To help demystify how to determine sample sizes, we’ve compiled these tips:

1. Work within your budget and time constraints. Yes, larger sample sizes typically produce more reliable results. But there comes a point where increasing your sample size doesn’t make economic sense (also known as the law of diminishing returns). Companies have limited time and monetary resources for research. Unless you’re trying to reach a more niche audience, increasing your sample size or confidence level won’t lead to more valuable insights about your customers. Understanding how much access you have to your target population will nudge you in the right direction.

2. Utilize agile research methods. With an agile research approach, you apply what you learn from your last survey to your next one. Instead of taking a gigantic sample for an omnibus survey, break up the research into smaller chunks. You can utilize smaller sample sizes and get valuable insights in less time.

3. Include open-ended questions. Don’t forget to include some open-ended questions to get context to help explain the results. Increasing your sample size to include more people may give you greater confidence in the results, but without open-ended questions, you won’t have any insights into why people answered a certain way.

4. Shoot for 300 to 500 people. As a general rule, aim for a sample size of 300 to 500 people. This achieves a good balance between cost-efficiency and low margin of error. Remember 300 pieces of quality feedback returned in less time is better than 1000 statistically significant results you had to wait months to get.

Take the Hassle Out of Collecting Your Sample

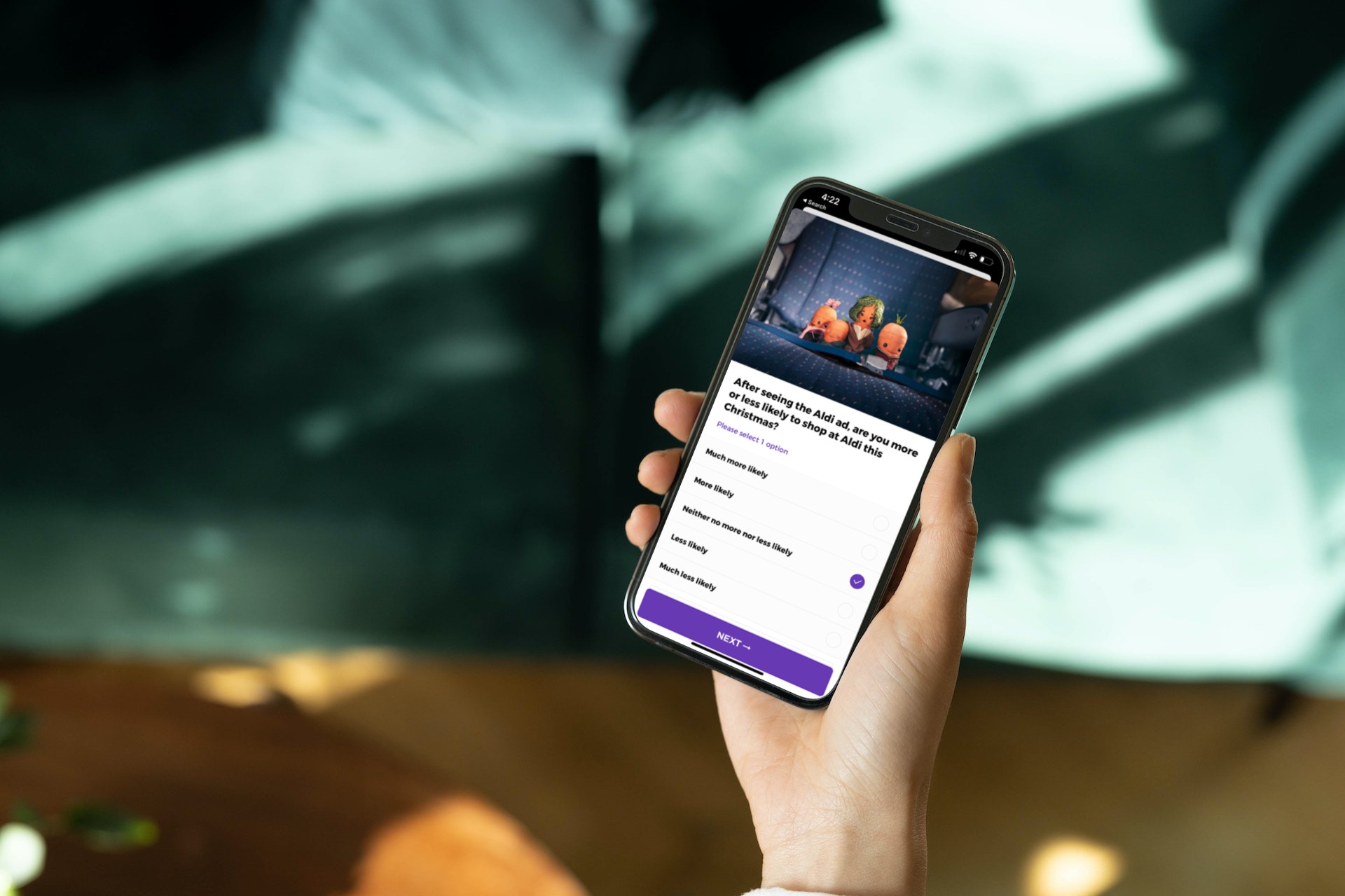

OnePulse’s mobile research platform takes the guesswork out of finding the right sample. With OnePulse, you can send a short three-question survey to our highly engaged audience and have 500 responses in under 15 minutes.

Related posts